In 2024, restaurants can reduce the cost of credit card processing through two different options: cash discount and surcharging. Both achieve a similar goal of cutting costs but are performed in different ways. At POS Philly, we believe cash discount with POS system like SpotOn is the better choice for restaurants. From a presentation point of view, it’s more psychologically appealing compared to simply adding a surcharge onto the bottom of a receipt. Let’s breakdown why cash discount is better than surcharging.

What are cash discount and surcharging?

These two merchant services options apply the cost of processing a card transaction to the consumer that is performing it rather than the merchant itself. This choice allows restaurants to pass on processing fees to customers when they choose to pay with a card or digital wallet. The cost of credit card processing can be in the tens of thousands on average for restaurants that have $500,000.00 in revenue or higher. Both cash discount and surcharging drastically reduce these costs.

Cash discount is the option to provide your customers with two payment options: one cost to pay with card, and a reduced price to pay with cash. For restaurants, this price is shown on the receipt at the end of the transaction. A point-of-sale provider builds the cost of processing fees into each menu item. At the end of service, a POS system adds up the total of the bill. The bill will have the menu items with the built in processing cost with a line underneath it saying PAY WITH CASH. This second line item is a discounted payment option the removes the built in processing fee.

Surcharging is alike to cash discount but performed differently. Credit card surcharging requires signage on the entrance of your restaurant, at the point of sale, and usually on your menus. This is legally required so that customers are aware of it before choosing to pay there. Rather than building in the processing fee and presenting a cash discount option, surcharging simply applies a fee to the overall bill. This fee is added on to the bottom of the bill. Customers can receive a sticker shock when they see the added on fee at the bottom of their receipt.

Why does this matter for restaurants?

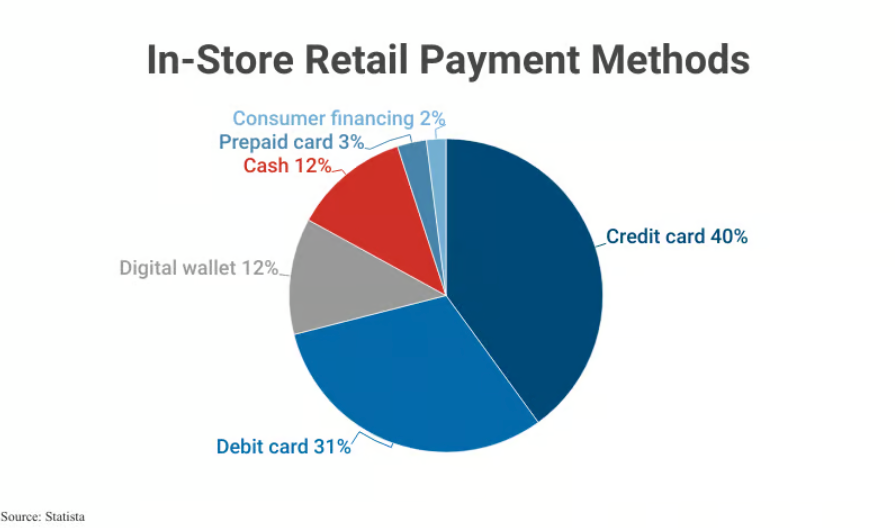

These options matter for restaurants because they reduce credit card processing fees. Credit card processing is a necessity for American restaurants in 2024. Card and mobile wallet payments continue to rise compared to cash ones. Consumers expect restaurants to accept digital transactions. The chart from Statista via Capital One Shopping below details that 86% of in-store transactions were performed with card and digital wallets in 2023.

Denying customers the ability to pay how they want to can turn away business. This means restaurants need to accept preferred payments in order to grow with modern payment trends. Part of accepting card payments is paying processing fees. According to Motley Fool, the average merchant processing fee is 2.24%. This is typically seen as a cost of doing business. With cash discount or surcharging, you can reduce these fees and lower that cost.

Let’s say a restaurant brings in $1,000,000.00 per year in revenue. Assume that, as Statista infers, that 86% of its transactions are by card. Of the $1,000,000.00 in revenue, $860,000.00 were from card and digital wallet transactions. Now take the 2.24% average in processing fees and apply it to the card transactions. $860,000.00 X .0224 = $19,264.00. With a program like SpotOn’s cash discount feature, a restaurant can reduce these fees by up to 85%. Doing so would bring the total cost processing card payments from $19,264.00 to $2,889.60. That’s a big deal!

Features like cash discount and surcharging matter because they reduce operation costs. The restaurant industry is known to have thin profit margins. By reducing processing costs, restaurants can expand profit.

How is cash discount better?

Cash discount is better than surcharging due to its presentation. With this option, the cost for processing with a credit card is already built into the menu item price. Even though signage may be posted for surcharging, customers may be surprised when they see the added on surcharge. That’s not the case with cash discount. Now, customers have a better idea of the total cost of their meal before choosing to order. This can avoid confusion and complaints.

Do customers react differently to discounts than surcharging?

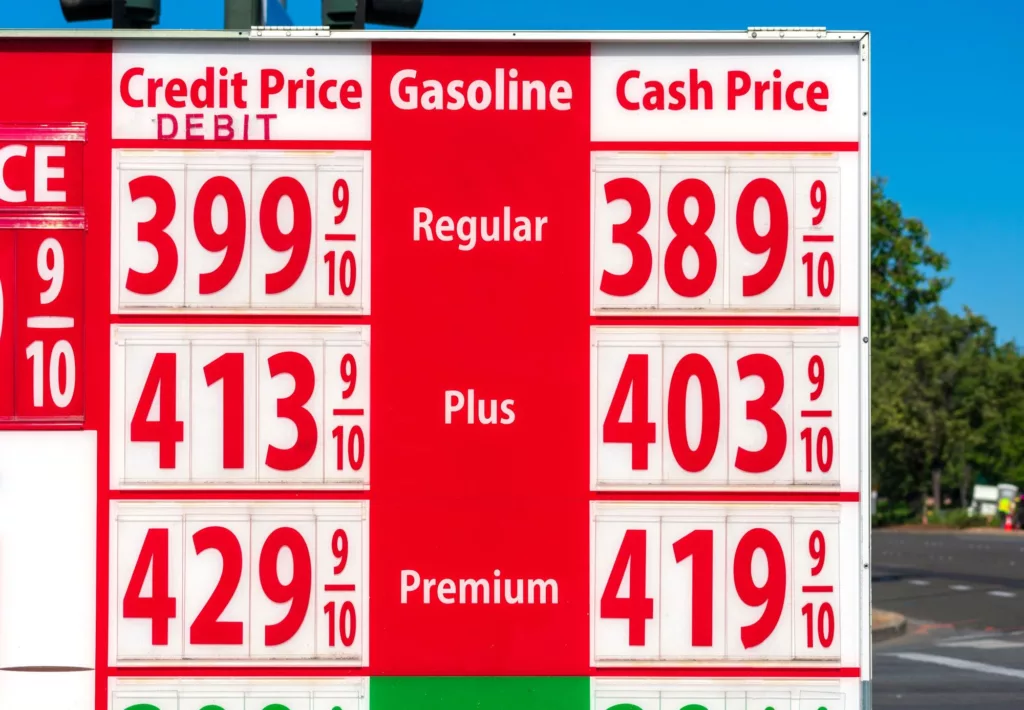

In our experience, restaurant owners that implement surcharging have less (in most cases, zero) pushback compared to surcharging. Most consumers are more receptive to receiving a discount if they use cash rather than seeing an additional surcharge if they use a credit card. The psychology behind the presentation of cash discount makes it a better deal for restaurant customers. Plus, customers may have more experience with cash discount. If they’ve been to a gas station, especially in New Jersey, they’ve already been exposed to different payment options for cash and card.

Is cash discount right for my restaurant?

With prices continuing to be higher than they were pre-pandemic, its important for restaurants to save money where it can. Prices for food purchasing, labor, and other aspects of restaurant operations are inflated and more costly than in 2019. Cash discount allows restaurants to reduce a major cost like credit card processing fees.

Cash discount can be incredibly useful for restaurants. Reducing fees can drastically free up cash to be spent on renovations, staff bonuses, and hiring new employees. Is your restaurant ready to save big with cash discount? Contact POS Philly today. Customers that perform processing with cash discount can qualify for free SpotOn POS hardware with their order.