Dual Pricing has become a hot topic in the restaurant industry. Commonly referred to as cash discounting, this software feature allows SpotOn users to save big. Restaurants that implement dual pricing pass on the cost of their credit card processing to their customers. This can be contentious for a lot of restaurants depending on their customer base. If you are a restaurant owner, you might ask, “How is this different than surcharging?” Great question. Let’s take a look at how SpotOn Dual Pricing works.

First, let’s answer how it is different than surcharging.

A credit card surcharge is an additional percentage added on during the transaction. The goal of the surcharge is to have a customer pay for the cost of processing a credit card. A surcharge is usually set at 3% – 3.85%. Restaurants cannot legally set a surcharge higher than 4%, according to SBDCNJ. At the bottom of a receipt, your customer will see the implemented surcharge. A statement is also often provided explaining the surcharge.

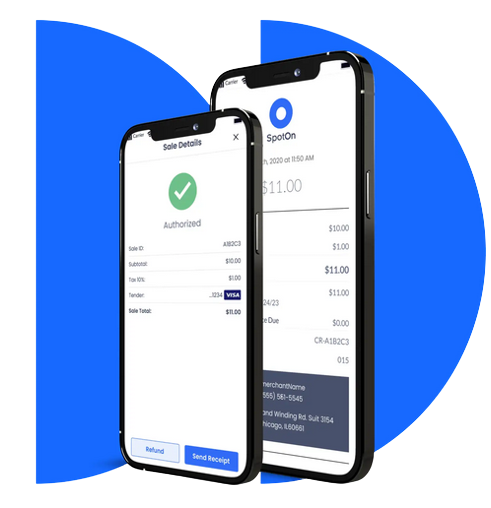

Imagine you are a customer and you see this. Wouldn’t you be a bit peeved? Surcharging has a higher probability of turning off your customer base. Dual Pricing, on the other hand, has a different approach. Rather than adding the surcharge as a separate price, SpotOn has the option to implement it into your menu items. Now, your credit card surcharge is built into the items itself. When a customer receives their check, they will see two options: Total and Pay With Cash. The total has the full item sale plus the surcharge built into the item price. The Pay With Cash line provides a discount on the total by removing the credit card surcharge.

How is this beneficial? There is a major psychological difference. Seeing an added surcharge can make a customer angry. Instead, offering a discount for using cash is a better presentation. Plus, a restaurant is now offering a lower price to their customers. That gives a better impression to the customer base as a whole!

Second, how is Dual Pricing programmed into SpotOn?

There is a process that goes into programming Dual Pricing. First, your project manager will write your entire database. Once completed & reviewed, we then add in the Dual Pricing percentage. This is automatically applied to every applicable menu item. Our staff then reviews the change and publishes it. POS Philly will also provide legally required signage explaining the usage of a surcharge, or ‘service fee’, during transactions. Restaurants can only apply this credit, not debit, card transactions.

Every day, a report will calculate total sales and deduct the Dual Pricing percentage from the daily sale. That report is then applied to your monthly credit card processing statement. Every month, SpotOn users will see their statement go from costing tens of thousands to little to none. The only costs would be for processing tips and no-junk monthly costs.

Third, why is this awesome for restaurants?

Let’s do math rather than writing a long paragraph.

Assume your restaurant has a revenue of $1,000,000.00 per year. 80% of transactions are performed through card. 33% of those transactions are debit cards. 67% are by credit card. Your restaurant’s credit card processing rate is 2.5%.

Your total credit card transactions total: $1,000,000.00 X .8 = $800,000.00 X .67 = $536,000.00 = $13,400.00 annually in fees.

Implementing Dual Pricing now effectively eliminates $13,400.00 per year, or $67,000.00 over 5 years.

$67,000.00 in savings. That’s why Dual Pricing with SpotOn is awesome for restaurants. Recoup those annual processing fees. Ease your overall operating costs to deal with inflation. Hire more part time help during the hospitality labor shortage. It’s as easy as 1-2-3 with this intuitive, automated software program.

Want Dual Pricing for your restaurant? Let’s talk! Contact us today to get started. Let’s save your business tens of thousands of dollars.